How Doug Ford's pledge of 'zero income tax' leaves minimum wage earners worse off

Doing the math reveals Liberal, NDP plan for $15 hourly rate puts more money in workers' pockets

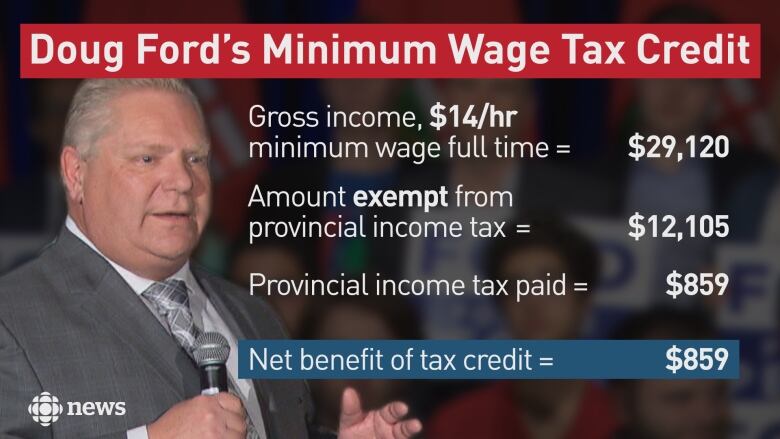

Ontario PC leader Doug Ford's big campaign promise for minimum wage workers, announced this week, is to offer them an income tax credit.

Ford is pitching this as relief for "folks that are working their back off for minimum wage." He said the move would give a full-time worker earning $14 an hour about $800 extra in a year.

Ford didn't mention that the same worker would get nearly twice that amount if the hourly minimum wage rises by $1 next year, something he is promising to stop.

CBC News did the math to compare Ford's income tax proposal with the Liberal and NDP pledge to boost the minimum wage to $15 per hour as of Jan. 1, 2019.

At the current rate of $14/hr, a full-time minimum wage earner has a gross annual income of $29,120. Factoring in the basic tax deductions available to all employees, that person would pay about $859 in provincial income tax. That would be the maximum tax credit available under Ford's plan.

- Doug Ford pledges tax break for minimum wage workers

- NDP releases election platform, including $12/day child-care plan

Raising the minimum wage to $15/hr gives that same full-time worker an extra $2,080 in gross annual income. After subtracting federal and provincial income taxes, Canada Pension Plan and employment insurance premiums, that worker takes home an extra $1,553 next year, under the Liberal and NDP plan.

It means the minimum wage increase leaves the worker with about $700 more than Ford's income tax credit would. CBC News showed the calculations to all three parties and to an independent economist for verification.

"You do come away further ahead with an increase in the minimum wage than you do with the promise of the minimum wage tax credit," said Sheila Block, an economist with the Canadian Centre for Policy Alternatives.

The proportionate advantage of the wage increase is even greater for part-time workers. For someone working 25 hours a week:

- Ford's plan would provide a tax credit of about $396 a year.

- the $15/hr minimum wage would provide extra take-home pay of about $970 a year.

Ford is trying to "disguise" his plan as something that would help low-wage workers, Labour Minister Kevin Flynn said Tuesday.

"He's reaching right into their pockets and taking money right out of their wallets," Flynn told reporters at Queen's Park.

"It's not helping poor working people in the province of Ontario at all. It's helping the rich people that Mr. Ford seems to like to associate with," he said. "It just doesn't wash; it doesn't make any sense."

"I have one question for Doug Ford: Why is he ripping off the lowest paid workers in this province?" said NDP leader Andrea Horwath.

"You're talking like you support these workers, and that you care about them. But by not giving them the minimum wage that's higher, you're going to be ripping them off."

PC officials say a Ford government would halt the scheduled minimum wage increase to $15 an hour on Jan. 1, 2019. They say Ford would not freeze the minimum wage but would allow it to rise annually by inflation.

The officials say a refundable tax credit would be provided to minimum wage workers equal to the amount of provincial income tax.

"We believe this is the right thing to do in order to help those people struggling to make ends meet," said party spokesman Simon Jefferies.

However, the tax credit would not apply to anyone who earns above minimum wage, the officials said.

When Ford announced the minimum wage tax credit in Ottawa on Monday, he slammed Premier Kathleen Wynne, whose government increased the minimum wage from $11.60 an hour last year to $14 an hour.

"What Kathleen Wynne doesn't tell you, is that she's still taxing those on the minimum wage," Ford said. "The people that are struggling day in and day out to put food on their table, they're still being taxed."

The provincial income tax rate is 5.05 per cent on earnings below $42,960, with the first $10,354 in earnings exempt.

Ford said under his plan, the province would bring in about $500 million less in annual revenue.

Detailed calculations

Doug Ford's Minimum Wage Tax Credit

$14/hr x 40 hrs/wk X 52 wks/yr = $29,120

Provincial income tax exemption = -$10,354

Deduction for CPP & UI premiums = -$1,751

Amount of income taxed = $17,015

Provincial income tax rate 5.05% x $17,015 = $859

Liberal/NDP Minimum Wage Increase

$15/hr x 40 hrs/wk X 52 wks/yr = $31,200

Extra gross income = $2,080

Extra CPP & EI premiums = $137.49

Extra income subject to tax = $1942.51

Taxed at provincial + federal income tax rate of 20.05% = $389.47

Extra net income: $2080 - $389.47 - $137.49 = $1553