Lessons from B.C.: What Toronto should consider before adopting a foreign buyers' tax

With Ontario reconsidering the levy, it must decide who would be taxed and how to spend the revenue

With the Ontario government indicating it may try to douse Toronto's scorching housing market with a foreign buyers' tax, critics and advocates of the move say the province has a lot to learn from British Columbia.

- Ontario mulls the idea of foreign buyers' tax

- Toronto's land transfer tax revenue is booming, but the cupboard's still bare

Economists have had mixed reaction as to whether the 15 per cent levy implemented in the western province in August 2016 can take full credit for the nominal cooling of real estate sales in Metro Vancouver.

And while Ontario Finance Minister Charles Sousa has yet to decide whether he'll follow British Columbia's lead, here are four factors he may be considering.

1. The B.C. government is being sued

Jing Li stands as the lead plaintiff in a class-action lawsuit filed less than two months after the foreign buyers' tax went into effect on Aug. 2. The Chinese national moved to the province after she completed a masters degree in public administration at the University of Saskatchewan.

She got a work permit and made a successful offer on a home.

Her statement of claim argues that the tax discriminates against foreigners, which violates the Charter of Rights and Freedoms and roughly 30 international treaties.

Li's lawyer, Luciana Brasil, argued that the B.C. government has stepped outside of its jurisdiction. She noted that Ottawa negotiated these treaties, including NAFTA, granting international citizens equal treatment as consumers.

"The problem with the tax is that the province does not have the power to impose taxes that are based on nationality," Brasil said Thursday.

The lawsuit has not yet been certified.

If the claim were successful, however, British Columbia would have to repay the revenue it's collected through the tax.

2. How much notice should Ontario provide buyers?

While Brasil said she's fundamentally opposed to the tax, she said that Ontario should pay attention to the problems that British Columbia encountered in its speedy rollout of the changes.

Her client, Li, paid a $56,000 deposit on her townhome in July 2016 — two weeks later, the tax went into effect. Li had a choice: forfeit her deposit or pay another $84,000 in taxes for the property.

She's one of an estimated hundreds of people who had been in the process of purchasing a home when the new levy came down. Many identified themselves as international students or temporary workers when they contacted CBC News in the summer and fall.

"There was no warning and a lot of people were caught in the middle," Brasil said.

3. Who would be affected by the tax?

There's been no indication of what a potential levy in Ontario might look like.

Initially in British Columbia, anyone who was neither a Canadian citizen nor a permanent resident had to pay a 15 per cent tax on the sale price of any property bought in the Metro Vancouver area after Aug. 2.

Several members of B.C.'s provincial New Democrats argued that the tax discriminated against foreigners, while still leaving too many loopholes for foreign investors.

"It penalizes new immigrants who are working and living here, but don't have citizenship yet," NDP MLA David Eby said in August. "I fear we're going to be back in six months fixing this problem."

He was right.

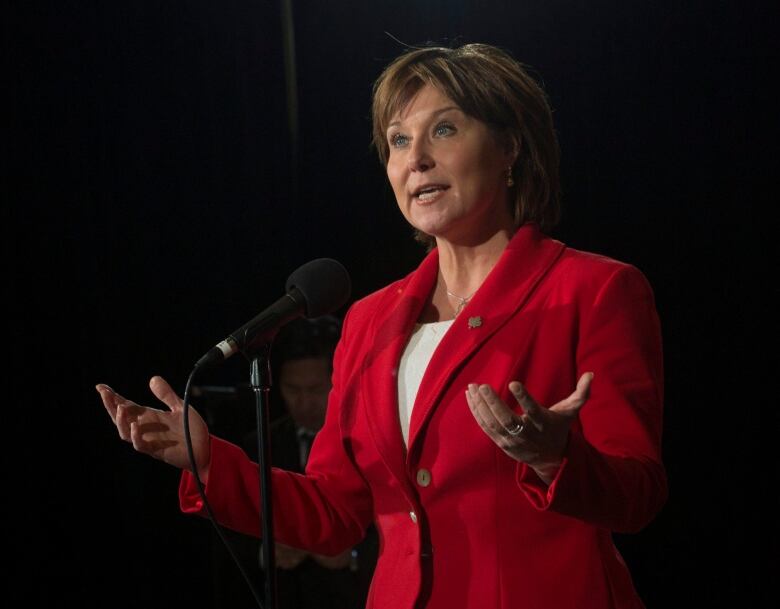

In January, Premier Christy Clark announced that anyone with a work permit who paid income taxes in British Columbia would be exempt from the home-buying tax.

The revised restrictions were meant to encourage immigration, she said then.

4. How would the revenue be spent?

British Columbia Finance Minister Mike de Jong earmarked the foreign buyers' tax revenue for affordable housing, rental and support programs when introducing the program in July.

It caught the attention of several Toronto councillors as this city contends with its own community housing crisis. More than 97,000 households are on the current wait list for a subsidized home in Toronto.

They can expect to be on that list a long time.

The average wait for a one-bedroom Toronto Community Housing unit has stretched to nine years, according to data from September 2016. Families looking for a three-bedroom home will, on average, have to wait more than seven years to move in.

Toronto Coun. Ana Bailao has already advocated for the city to apply some of its surplus land transfer tax revenue toward improving access to affordable housing.

Real estate wars have seen the municipality projecting a surplus of $55 million this fiscal year; a windfall on top of the $485 million in revenue first projected.

"I believe that as we introduce revenue tools we should be tying them to certain areas and projects," she said in an interview last year. "And I think housing is an area that needs something going towards that."

With files from Jane Armstrong