Thousands of Canadian residents hit by Trump tax get temporary reprieve

Many Canadian residents facing tax bills of hundreds of thousands of dollars - or more

Thousands of Canadian residents who are facing massive tax bills as a result of the sweeping tax reform U.S. President Donald Trump signed into law in December have been given a temporary reprieve.

With only days to go before a deadline of June 15 to make the first payment, the U.S. Internal Revenue Service (IRS) announced last week that many of those hit by the new repatriation or 'transition' tax will now have until April 15, 2019 to make their first instalments.

However, Canadian residents who owe more than $1 million in repatriation taxes are out of luck. They will have to make their first payments later this week or face late-payment penalties.

Meanwhile, the angst over this the one-time, retroactive tax has started to convince the U.S. Congress to come up with a permanent solution for thousands of Canadian residents who are grappling with its impact.

The measure was intended to get big American multinational corporations like Apple and Microsoft to stop parking billions of dollars in foreign subsidiaries. But it's also hitting U.S. or dual citizens here who have corporations — many of them people who have lived much of their lives in Canada.

Many of those people are facing tax bills amounting to hundreds of thousands of dollars on all of the retained earnings in their corporations going back to 1986. Some are facing bills in the millions of dollars.

Those who have been using their corporations to save for retirement are being hit particularly hard.

While the tax is being levied on money sitting in corporations, it's the owners who have to declare the money on their 2017 personal tax return.

Double jeopardy

If they have to take money out of their corporations to pay the tax, they risk a double-whammy – having to pay tax to the Canadian government on the money they take out to pay the IRS.

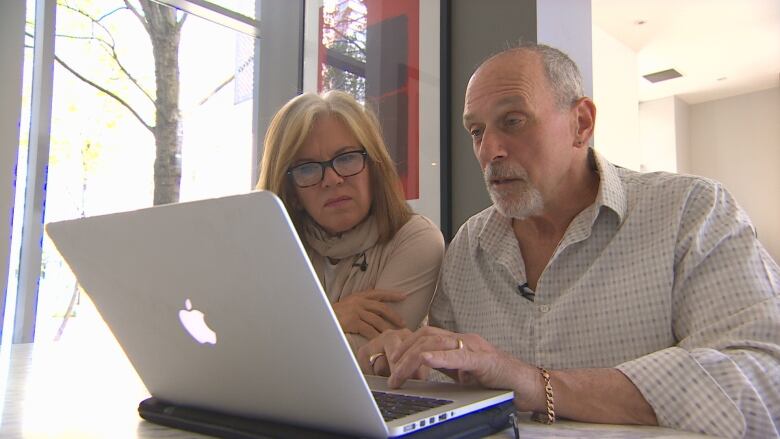

Suzanne and Ted Herman own a small Vancouver-based film company and had been using the company to save for their retirement. The dual Canadian-U.S. citizens are facing a six-figure tax bill that has been keeping them awake at night.

Suzanne Herman said the U.S. government's decision buys them some time but they're still worried.

"We're looking at a delay, but it's still looming," she said.

Ted Herman said they're even more concerned by a second measure in the tax reform — the Global Intangible Low Taxed Income (GILTI) tax, which was intended to stop American companies from shifting profits to foreign subsidiaries in low-tax countries.

"The GILTI tax essentially would not make it beneficial to be in business any more in Canada," he said, pointing out that their company employs 100 Canadians on and off.

"If it doesn't go away, I've got to shut the business down because I'll be working just to pay tax. I won't make any income. Essentially 25 cents on the dollar. That is what I would be able to keep."

The Hermans are planning to follow the advice coming from many experts, and ask for an extension until Oct. 15 to file their 2017 tax return.

Toronto lawyer John Richardson said the reprieve is welcome news for most Canadian residents affected by the repatriation tax.

"Clearly that would be a benefit for an awful lot of people with Canadian-controlled private corporations who have been using their corporation over the years to accumulate income to use as a private pension plan," he said.

"So, it is going to help an awful lot of people. There is a group of people who are not going to be helped but I expect that those who are stuck with the June 15 deadline probably have been the beneficiaries of the kind of professional advice that is really needed to deal with this."

Legislation coming

Monte Silver is a Canadian-born lawyer based in Israel, where he specializes in helping American expats with tax issues. He said the delay announced by the IRS will help most of the people he has spoken with who are affected by the repatriation tax.

"The vast majority are covered by this reprieve."

Silver estimates 8,000 residents of Israel are affected by the tax.

Now, he said, attention is turning to convincing Congress to adopt a legislative solution, exempting Americans living outside the U.S. who are shareholders in controlled foreign corporations from both the repatriation tax and GILTI.

A petition launched this week on AmericansAbroadForTaxFairness.org is encouraging people to contact key politicians, Silver said.

"We're pinpointing Democrats and Republicans on the tax committees — especially those who are up for election — and we are going to make sure that they hear us very loudly and very clearly."

Brian Masse, an NDP MP who sits on the Canada-United States Interparliamentary Group, said U.S. lawmakers were very much aware of the tax reform's unintended consequences when MPs and senators met with them in Washington last month.

Masse said he was told legislation to fix the problem could be introduced in the coming weeks.

"There seemed to be a genuine understanding and appreciation that these are victims."

Elizabeth.Thompson can be reached at [email protected]